Real Estate Investing: How to Build a Profitable Portfolio

B

logkoopedia - Real estate investing can be a lucrative and rewarding way to build wealth over the long-term. But like any investment, it requires careful planning, research, and strategy. In this article, we’ll explore the key elements of real estate investing and provide tips on how to build a profitable portfolio.Know Your GoalsBefore you start investing in real estate, it’s essential to define your goals. Are you looking to generate passive income or build long-term wealth? Do you want to invest in residential or commercial properties? Understanding your goals will help you develop a plan that aligns with your needs and aspirations.

Research the Market

The real estate market is constantly changing, and it’s important to stay informed about trends and conditions. Research the areas where you’re interested in investing and look for patterns in pricing, demand, and supply. Factors like location, accessibility, and amenities can all impact the value of a property, so it’s important to do your due diligence before making a purchase.

Build a Network

Real estate investing requires a team of professionals to help you navigate the process. This may include real estate agents, attorneys, accountants, and contractors. Building a strong network of professionals can help you find deals, negotiate contracts, and ensure that your investments are financially sound.

Start Small

Investing in real estate can be expensive, so it’s important to start small and work your way up. Consider investing in single-family homes or duplexes before moving on to larger multi-unit properties. This will help you build a track record and gain experience before taking on more significant investments.

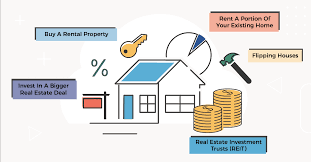

Diversify Your Portfolio

Diversification is key to building a profitable real estate portfolio. Don’t put all your eggs in one basket and invest in a variety of properties and locations. This will help you spread your risk and minimize the impact of any downturns in the market.Develop a Strategy

Real estate investing requires a long-term strategy that takes into account your goals, resources, and risk tolerance. Some investors prefer to buy and hold properties, while others focus on fix-and-flip projects. Whatever your strategy, make sure it aligns with your goals and is based on sound financial principles.

Manage Your Properties Effectively

Managing your properties effectively is essential to generating long-term profits. This may include finding and screening tenants, maintaining the property, and dealing with any repairs or maintenance issues. Outsourcing some of these tasks to a property management company can help you save time and ensure that your properties are being managed effectively.

Stay Informed

Finally, it’s important to stay informed about the real estate market and any changes in regulations or laws that may impact your investments. Attend seminars, read books, and follow industry publications to stay up-to-date and informed about trends and developments in the market.

Last Thoughts

In conclusion, real estate investing can be a profitable and rewarding way to build long-term wealth. By following these tips and developing a sound investment strategy, you can create a portfolio of properties that generates passive income and helps you achieve your financial goals. Remember, real estate investing requires patience, diligence, and a willingness to take calculated risks. But with the right approach, it can be an excellent way to build a profitable portfolio and secure your financial future.

Related:

- How to Build a Successful Customer Relationship in Just 10 Minutes a Day

- G Suite Account Sign Up - How Do I Use Gmail For Business Email?

- The 28 Real Ways How To Make Money From Internet - Earn Money Online

- 10+ Tips Work Life , How to be More Productive Everyday

- Investing in Insurance vs Finance: Which Offers Better Returns?

No comments:

Tulis comments